Can buying a Ferrari protect you against inflation?

Harry EdworthyShare

In this newsletter, we go into greater detail about one of Autofolio’s investment attributes for collectable cars ‘Preservation’. A factor that makes collectable car ownership attractive as an asset class. Showcasing why you should buy your collectable car today, not tomorrow…

As new cars become more and more expensive driven by inflationary pressures, it has a natural drag on the valuation of cars in the used market, as these cars are now offered at more attractive valuations. In addition, many collectors and enthusiasts value these cars for their unique features, design, and craftsmanship that do not feature on newer models, which further adds to their desirability and potential for appreciation.

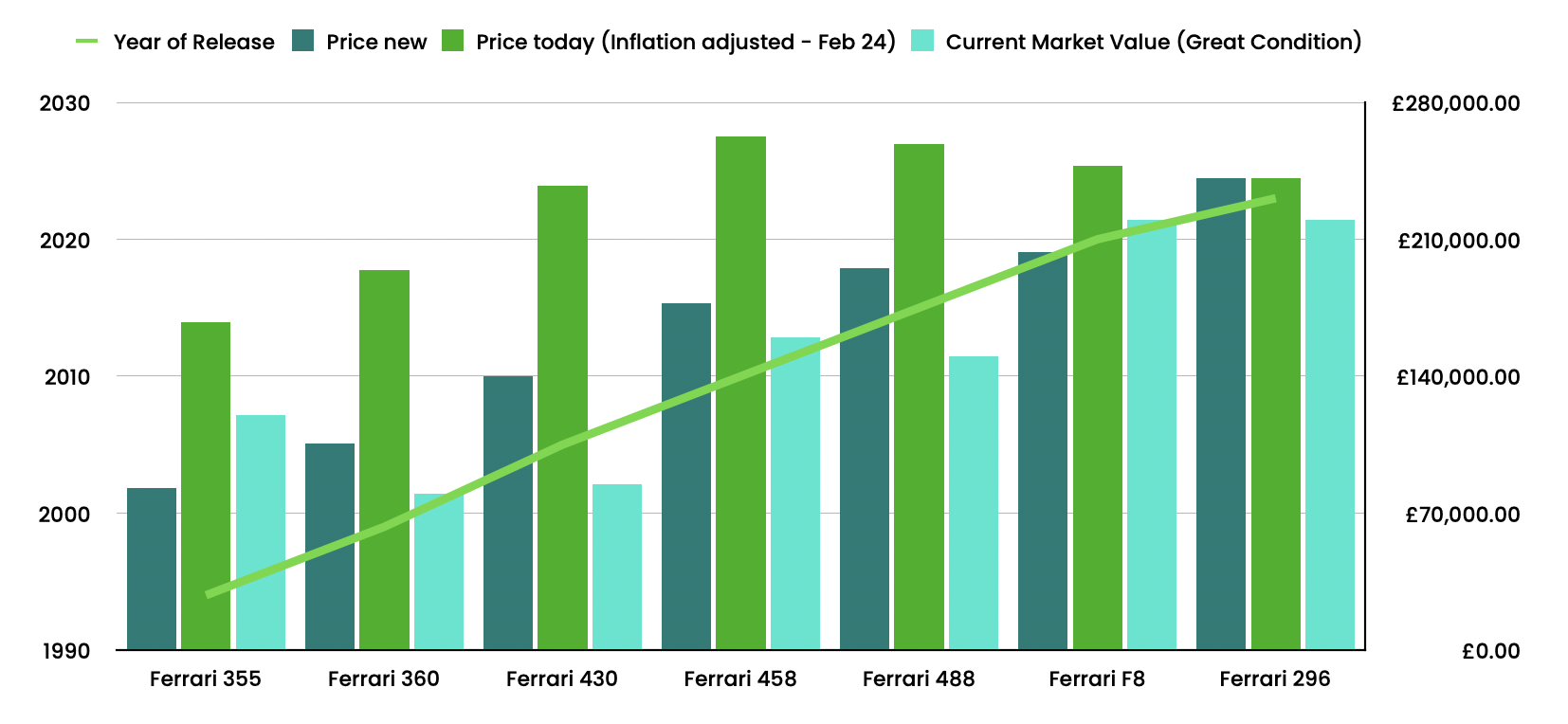

The chart below shows price analysis on mid-engine standard production Ferraris over the last 30 years. From the 355 to the latest car in Ferrari’s line up the 296. The chart analyses each model’s list price when new, the real price today (price today adjusted for inflation), and the model’s estimated market value today.

Example: Mid Engine Ferrari’s

What can we learn from the chart?

1. Ferrari increases prices ahead of inflation *However, this is not the case for the last three generations

2. The Ferrari 458 was the worst value to buy new

3. The Ferrari 355 was the best value to buy new

4. Nominal return: 355 and F8

5. Nominal loss: 360, 430, 458, 488, 296